Company Tax Computation Format Malaysia

This condition needs to be met throughout the period beginning with the start of the latest 12 month period in which the company held a substantial shareholding test and ending with the. Allow MULTIPLE PERIOD for tax computation of partnerships business income.

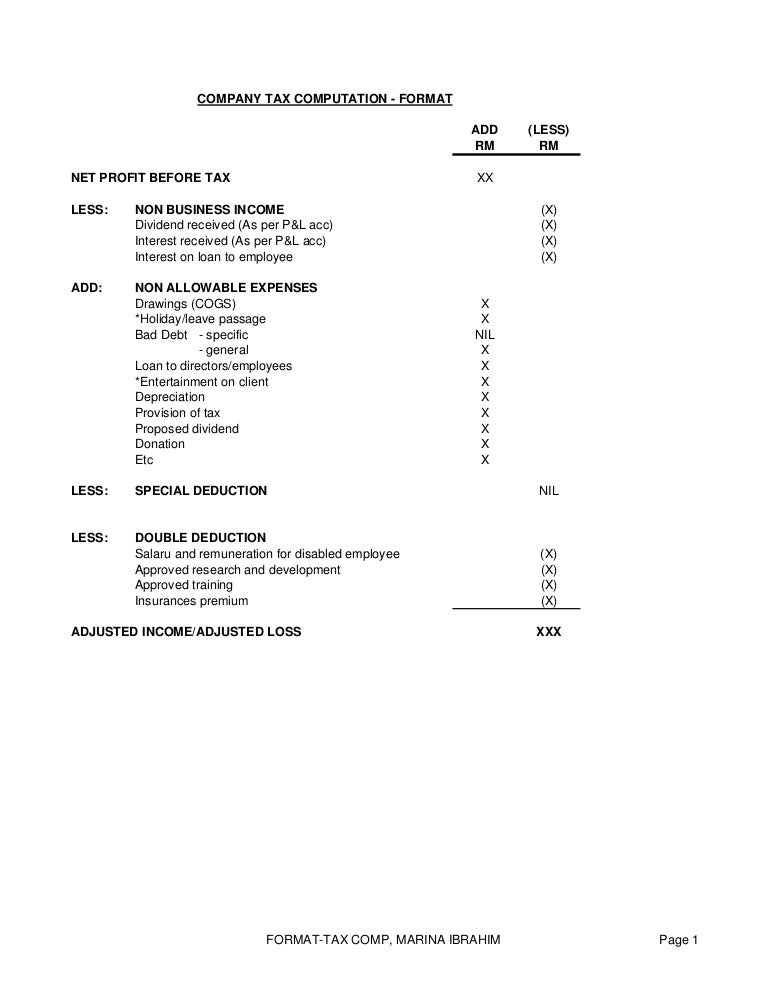

Company Tax Computation Format 1

Tax Guru is a reliable source for latest Income Tax GST Company Law Related Information providing Solution to CA CS CMA Advocate MBA Taxpayers.

. Format of audit report changing as the standard applied has changed from MFRS to MPERS. Tax Secretary MBRS RPGT Time Cost Accounting Software in Malaysia. Bir issued atp to us service invoice instead of sales invoice.

My company paid my salary and i have the obligation to pay all income tax myself. The different auditing this type of company is that it will be in Bahasa Malaysia. Check company information and statutory filing deadlines.

Besides there is no company secretary being appointed. A connected persons requirement ensures that the rule focuses on those cross-border tax planning arrangements that are designed to shift an amount from the source. The investee company ie the company whose shares are being sold must be a trading company or the holding company of a trading group or subgroup to qualify for the main SSE exemption.

Salaries of the employees of both private and public sector organizations are composed of a number of. Controlled company - interpreted under Section 2 Income Tax Act 1967 ITA 1967 as a company having not more than fifty members and controlled by not more than five persons in the manner described by Section 139 ITA 1967. Now i would like to know how.

The reporting entitys assertion that it cannot reliably estimate its annual effective tax rate should be disclosed so that financial statement users can understand the manner in which the interim tax provision was. If a reporting entity determines that it is unable to reliably estimate its annual effective tax rate the discrete-period computation method may be used. However such GST paid is also allowed as Input tax credit in same month and therefore net liability of tax will not increase.

Vi skulle vilja visa dig en beskrivning här men webbplatsen du tittar på tillåter inte detta. HRA or House Rent allowance also provides for tax exemptions. Income Tax Assessment Year 2023-24.

Article contains Automatic Income Tax Calculator in Excel Format for Financial Year 2022-23 FY 22-23 ie. My questions is if to pay the tax obligation before i leave do they give me proof i have paid my taxes as immigration might want to see it or will they now know or be. Xero Tax displays the company information stored at Companies House.

SUPERIOR IT SOLUTIONS SDN. MALAYSIAN TAXATION 2 covers tax computation for partnership and company which includes the deductions of capital allowances and investment incentives as provided under the tax laws and continues with computation of real property gains tax and indirect. You can edit the format of the company name and directors names if you dont want to use the Companies House format.

Miguel de Serpa Soares the Under-Secretary-General and United Nations Legal Counsel. I have a yearly rented property here i have company letter cancelling my WP. Acting on the recommendation to prevent erosion of Indias tax base the Income Tax Act 1961 was amended in April 2001 by substituting the existing section 92 and inserting sections 92A to 92F to introduce Indian transfer pricing regulations TPR in line with Article 9 of the Organization for Economic Co-operation and Development Guidelines OECD guidelines on.

This service is listed under the reverse charge list therefore trader has to pay tax 18 on Rs. Limiting the scope of the rule to covered payments between connected persons is in line with the policy and purpose of the STTR as articulated in section 91 above. Click the preview icon to view the accounts tax return or tax computation summary in document format.

The different Sections of the Income Tax Act help the salaried individuals and the self-employed people and professionals to make their rent expenditures cheaper and more desirable. My WP and non-b visa finish in early 2019. Innovations Group UAE 118544 followers on LinkedIn.

My business permit says im a retailer although my company name includes services. Superior Tax Comp Superior ComSec Superior TimeCost Superior SST. Its all about people The Innovations Group has been operating within the UAE for close to 2 decades and is one of the market leaders in.

Defined value DV DV value for real property means market value of the real property. This course exposes various types of business documents and format which also. It will also be the basis of the output tax liability of the seller and the input.

Format of delivery receipt does not bear any amount for. Knowledges on how to prepare tax computation hire purchase and how to prepare audit report using MPERS and PERS. Example A trader who is registered in GST takes services of Goods Transport Agency GTA for Rs.

Company Tax Computation Format

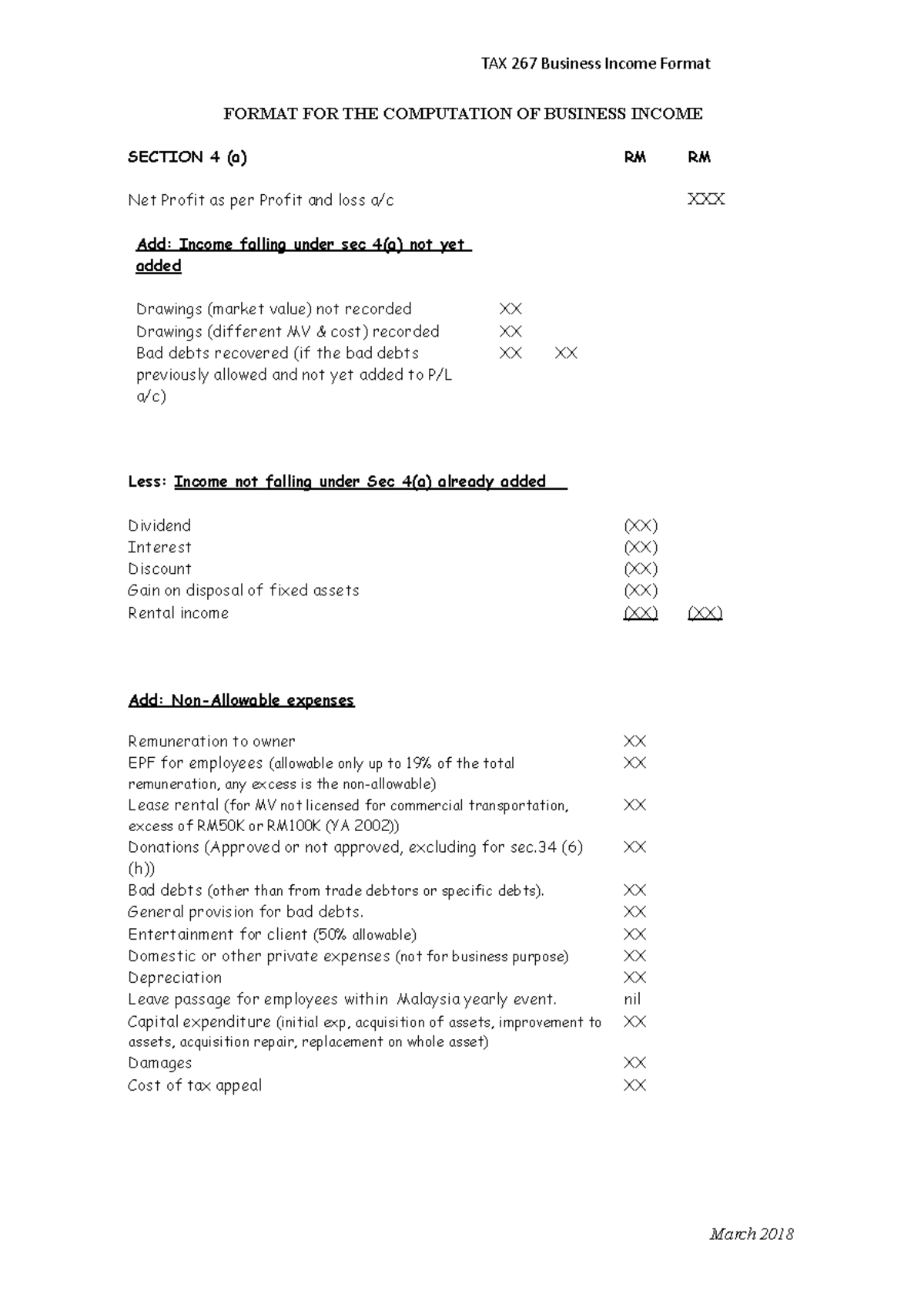

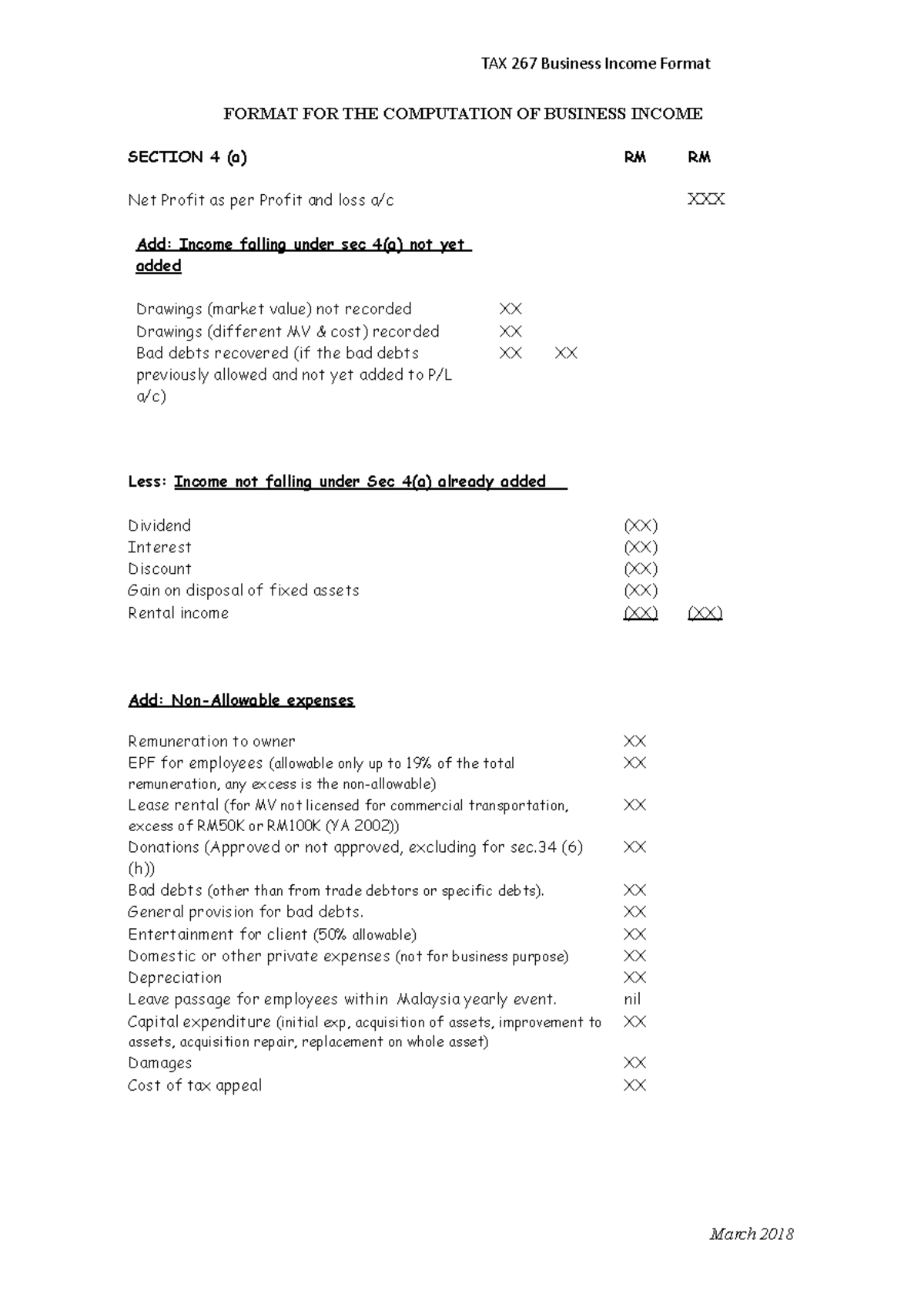

Format For The Computation Of Business Income Tax 267 Business Income Format Format For The Studocu

Tax Computation Format Lessor Company Name Computation Of Chargeable Incom For Ya Xxxx Rm Leasing Business Gross Income Less Wholly Exclusively Course Hero

Format Computation 1 Xlsx Computation Of Chargeable Income Tax For Ya Xxxx Husband Wife S 4 A Business Income Adjusted Income Add Balancing Course Hero

Belum ada Komentar untuk "Company Tax Computation Format Malaysia"

Posting Komentar